What is emotional investing?

Four emotions that can

affect investing decisions are:

- Excitement that a certain investment will continue to perform

well

- Fear that market prices are going down

- Optimism that your current plan will always be a good fit

- Anxiety may control your ability to be smart about investing

What causes it?

Emotional investing can be driven by:

- Market volatility: The rate at which market investment prices

go up and down

- Hearsay: Excitement or trepidation about a specific investment

based on what others are saying

The

financial cost and risks of emotional investing

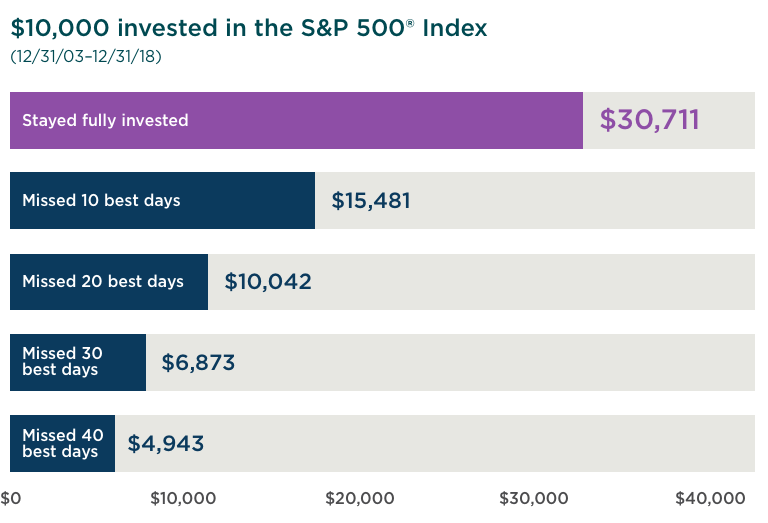

The image below shows how much an

account with a $10,000 balance could grow if kept fully invested in the S&P 500. It also shows

the growth you could miss out on if you allow emotions to remove your money.

Data is historical. Past

performance is not a guarantee of future results. The best time to invest assumes

shares are bought when market prices are low.

By staying fully invested over the past 15

years, you would have earned $15,230 more than someone who missed the market’s 10

best days.1

Using emotions as a decision for investing can

be a dangerous roller coaster ride.

Some of the risks include:

- Money loss

- Negative impact to your returns by missing a few days in the market

Four ways to avoid

emotional investing

- Make a long-term plan

- Make investing a habit

- Check and recheck your investment strategy

- Learn from past mistakes

[1]

https://www.putnam.com/literature/pdf/II508-ac37f7ad02b2d8889f7e5361f0e8ac86.pdf

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of

leading large-cap U.S. companies in leading industries; gives a broad look at the

U.S. equities market and those companies’ stock price performance.

Investing involves market

risk, including possible loss of principal, and there is no guarantee that

investment objectives will be achieved.