What is rebalancing?

It’s the idea of keeping your investment portfolio aligned with your original plan. It’s an important way to stick with your investing style and original objectives.

Let’s say that you have part of your assets invested in the stock market. And over a period, stocks do really well. Eventually, too much of your retirement account balance might be made up of stocks, which doesn’t align with your goals. Or your investing style.

Why is rebalancing important?

- Give you the opportunity to take a new look at all the investment options in your portfolio

- Force you to take profits from the investment options which have run up and put money in those that may have merit but haven’t gone up

- Smooth investment returns

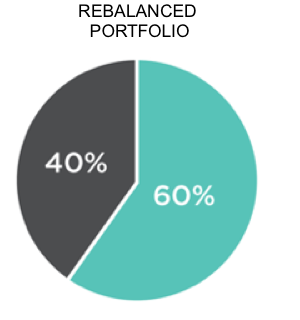

- 60% stocks

- 40% bonds

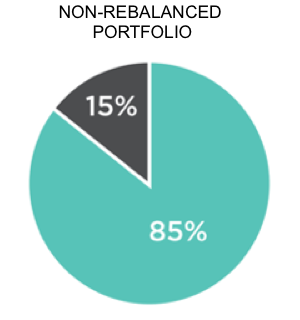

- 85% stocks

- 15% bonds

Investing involves risk. You could lose money. And there is no guarantee that investment objectives will be achieved.

Asset allocation, rebalancing and diversification do not assure a profit or protect against loss in a down market.